Portfolio Optimisation - Hierarchial Risk Parity

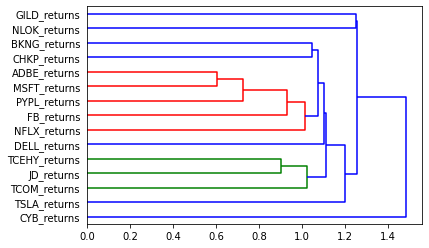

The team for this project explored the use of Hierarchial Risk Parity. The Mean-Variance based portfolio optimisation (Markowitz Portfolio Theory), studied in a standard finance course such as FM212 or FM213 involves the construction of a portfolio based on the covariance matrix. However, the covariance matrix only accounts for the covariance between pairs of assets. Hierarchial Risk Parity uses hierarchial clustering to build clusters of assets - accounting for possible factors, then calculates covariances between clusters from which a portfolio can then be constructed.

A Google Colab notebook is available here

And the slides to their presentation are available here

References

-

https://gmarti.gitlab.io/qfin/2018/10/02/hierarchical-risk-parity-part-1.html

-

https://hudsonthames.org/an-introduction-to-the-hierarchical-risk-parity-algorithm/